Welcome to our blog post on the intriguing topic of why the average cost curve is U-shaped. Understanding cost curves is vital in the world of economics, as they provide insights into how businesses operate and make decisions. When it comes to analyzing costs, one curve stands out – the average cost curve. But why does it take the shape of a U? In this post, we will explore the reasons behind this U-shaped phenomenon, providing you with a comprehensive understanding of the average cost curve and its implications.

Before we dive into the specifics of the average cost curve, let’s briefly touch upon the classification of costs. It’s essential to differentiate between direct and indirect costs, as well as fixed and variable costs. This distinction helps us grasp the intricacies of how costs are incurred and, ultimately, how they contribute to shaping the average cost curve. So, if you’ve ever wondered about the relationship between direct and indirect costs, or how fixed costs impact the curve, keep reading – we’ve got you covered!

So, get ready to unravel the mysteries of the average cost curve and gain insights into its U-shaped pattern. By the end of this blog post, you’ll have a solid understanding of why the curve behaves as it does, allowing you to look at cost analysis through a whole new lens!

Let’s begin our journey into the fascinating world of the average cost curve.

Why is the Average Cost Curve U Shaped?

When economists talk about the average cost curve, you might imagine a roller coaster ride or maybe a U-shaped smiley face. But what’s the deal with this shape? Why does it curve in such a peculiar way? Well, hold on tight because we’re about to take a thrilling journey into the world of average costs!

The Early Stages: Diminishing Marginal Returns

Picture yourself starting a lemonade stand. At first, it’s just you and a small table. You squeeze those lemons with all your might and produce a couple of glasses. But as you add more workers and equipment, things get more efficient. Your production skyrockets, and the cost per glass drops – that’s the magic of diminishing marginal returns.

The Sweet Spot: Increasing Returns to Scale

As your lemonade stand operation continues to grow, economies of scale kick in. You open a bigger shop, hire more workers, and invest in fancy lemon squeezers. Suddenly, your production shoots up, and the cost per glass plunges even further. It’s like finding a pot of gold at the end of a rainbow, except with lemons and dollars.

The Turning Point: Diminishing Returns to Scale

But beware! There comes a point when the shop gets too big for its own good. You’ve maxed out your production capacity, and adding more workers or equipment only leads to chaos. Costs start creeping up, and your average cost curve takes a turn for the worse. This is what economists call diminishing returns to scale.

The Downhill Journey: Diseconomies of Scale

Once you’ve hit that turning point, things can quickly spiral out of control. Your lemonade stand becomes a lemonade mansion, complete with unnecessary expenses and bureaucratic nightmares. It’s like juggling lemons while riding a unicycle on a tightrope. Everything becomes more difficult, and costs skyrocket, dragging your average cost curve downhill.

A Word of Advice: Find Your Optimal Size

Finding the optimal size for your lemonade stand is like walking a tightrope. You don’t want to be too small and miss out on the advantages of scale, but you also don’t want to get too big and drown in inefficiencies. It’s all about striking the perfect balance and maximizing your lemonade profits!

And there you have it! The average cost curve is U-shaped because of the interplay between diminishing and increasing returns to scale. As your business expands, costs initially decrease due to better utilization of resources. However, once you hit the turning point of diminishing returns to scale, costs start to rise again, leading to a U-shaped average cost curve. So, next time you see that U-shaped smiley face, you’ll know there’s a lot more to it than meets the eye. Keep hustling like a lemonade tycoon, my friend!

FAQ: Why is the Average Cost Curve U Shaped?

Welcome to our comprehensive FAQ guide on the topic of why the average cost curve is U shaped. If you’ve ever wondered about the peculiar shape of this curve and its implications for costs in economics, you’re in the right place. We’ll answer common questions, debunk myths, and provide valuable insights with a touch of humor along the way. Let’s dive in!

How do You Classify Direct and Indirect Costs

In the realm of costs, direct and indirect expenses play integral roles. Direct costs are those that can be directly linked to a specific product or service. They include the raw materials used to manufacture a product or the wages of workers directly involved in its production. On the other hand, indirect costs are not directly traceable to any specific product or service. These costs, such as rent, utilities, or administrative expenses, contribute to the overall production process but cannot be allocated to individual units.

How is the Fixed Cost Curve

Ah, the fixed cost curve, a stalwart in the world of economics. Fixed costs are those expenses that remain constant regardless of changes in output. They include costs like rent, insurance, and salaries. As a result, the fixed cost curve appears as a horizontal line on a graph. Think of it as your office rent steadfastly refusing to budge while your productivity fluctuates. It’s like having a silent, stubborn friend who’s always there, no matter what.

Which of the Following Cost Curve is U Shaped

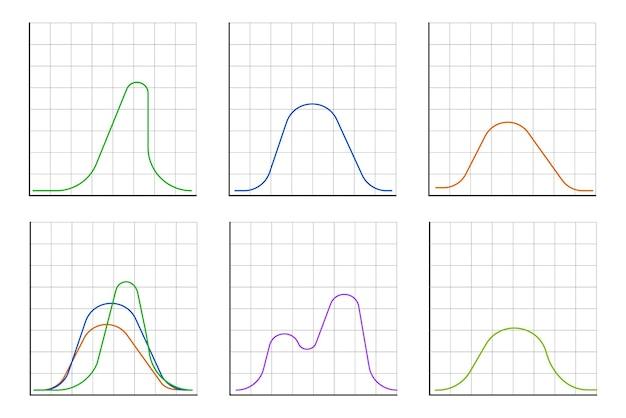

The cost curve that takes center stage in our FAQ today is the average cost curve (AC). Often misconstrued, the average cost curve showcases a U-shaped pattern. This curve represents the average cost per unit of output, reflecting both fixed and variable costs. As production increases initially, the curve slopes downward due to economies of scale. However, beyond a certain point, the curve starts sloping upward due to diseconomies of scale. So, remember, it’s the average cost curve that sports the U shape, not your morning bagel.

Why Does MC Cut AC at its Minimum

Now, let’s talk about the intriguing meeting point of MC and AC. MC, or the marginal cost curve, represents the additional cost incurred by producing one more unit of output. Interestingly, the MC curve intersects the AC curve at its minimum point. This happens because when MC is below AC, producing one more unit actually reduces the average cost. Conversely, if MC is above AC, producing an additional unit increases the average cost. It’s like MC and AC performing a synchronized dance routine, with their intersection being the grand finale.

How do You Determine Direct and Indirect Expenses

Determining direct and indirect expenses can be akin to detective work. Direct expenses, as previously mentioned, are those that can be specifically attributed to a product or service. Keep track of expenses that directly relate to the production process, such as raw materials, direct labor costs, or components used in manufacturing. Indirect expenses, on the other hand, require a bit more sleuthing. Identify costs that support the overall production but are not directly tied to individual products. These might include rent, utilities, or other overhead expenses.

Is Rent a Debit or Credit

Ah, the age-old battle between debits and credits. In the accounting realm, rent is typically classified as an expense, falling under the debit side of the equation. Expenses, including rent, reduce the overall profitability of a business. So, next time you pay your rent, remember to give a little nod to your faithful debit companion.

What Does AFC Curve Look Like & Why

The AFC (average fixed cost) curve may not be as flashy as the others, but it still deserves some attention. AFC represents the fixed cost per unit of output and always decreases as production increases. Picture it like your favorite cozy sweater that stretches just enough to accommodate your ever-expanding productivity. As you produce more units, the fixed costs get spread out, leading to a decline in the average fixed cost. It’s a comforting sight in the world of cost curves!

What is the Relationship Between AVC and MC

The AVC (average variable cost) and MC (marginal cost) curves are buddies who like to keep each other company. The AVC curve portrays the average variable cost per unit, while MC represents the additional cost for producing one more unit. When MC is below AVC, the AVC curve decreases. Conversely, if MC is above AVC, the AVC curve increases. Just like friends, they share a close bond and always keep each other in check.

How do You Classify Costs

Cost classification is a complex puzzle with various dimensions. Costs can be classified based on their behavior, such as fixed costs, variable costs, or mixed costs. They can also be categorized as direct costs or indirect costs, depending on their attribution to specific products or services. Additionally, costs can be classified as explicit (directly measurable) or implicit (opportunity costs). Oh, the beauty of classification – it brings order to the chaotic world of costs!

What Type of Cost is Raw Materials

Ah, good old raw materials – the building blocks of numerous products. In terms of cost classification, raw materials fall under the category of direct materials. These materials are specifically identifiable and directly used in the production of goods. Whether it’s flour for baking bread or fabric for sewing clothes, raw materials are the unsung heroes who find their place in the final products we love.

What is the Total Fixed Cost Curve

The total fixed cost (TFC) curve showcases the unyielding nature of fixed costs, the immovable pillars of your business. Represented by a straight horizontal line on a graph, the TFC curve remains constant regardless of the level of production. It’s like that one friend who always shows up, be it rain or shine, in sickness and in health. So if you’re feeling down, remember your reliable TFC curve is on your side.

Congratulations! You’ve reached the end of our engaging FAQ guide on why the average cost curve is U shaped. We hope this comprehensive and entertaining exploration has deepened your understanding of cost curves and shed light on their mysterious U-shaped nature. Remember, next time you encounter these curves in your economic adventures, don’t forget to unleash a knowing smile – the U shape is the secret language of costs. Keep learning, keep questioning, and keep embracing the captivating world of economics.