Safe deposit boxes are often a trusted space to store our most valuable possessions and important documents. However, when financial difficulties arise and creditors are seeking to collect on unpaid debts, many people wonder if their safe deposit box is safe from garnishment. In this blog post, we will delve into the topic of whether a safe deposit box can be garnished and explore the legalities surrounding this issue in 2023.

As we delve into this important topic, we will also address related questions such as whether a creditor can seize a joint bank account, how many notices the IRS sends before levy, and if levy payments are made on a monthly basis. Understanding the laws and regulations surrounding garnishment and asset protection is crucial for safeguarding our valuables and ensuring our financial stability. Let’s dive in and uncover the truth about the safety of our safe deposit boxes in the face of garnishment.

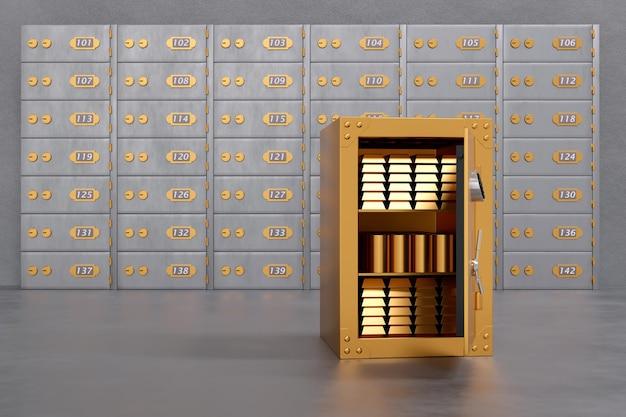

Can a Safe Deposit Box be Garnished?

Safe deposit boxes: the vaults of mystery where people store their most valuable possessions. But can these seemingly impenetrable boxes be touched by the hands of debt collectors? Let’s delve into the depths of the legal world to find out if a safe deposit box can be garnished.

The Iron Clad Box of Confusion

When it comes to the question of whether a safe deposit box can be garnished, the answer, like many legal matters, is a resounding…maybe. The laws surrounding safe deposit boxes and garnishment vary from state to state, making it difficult to give a one-size-fits-all answer.

State of the States

In some states, such as California, the contents of a safe deposit box are considered off-limits to creditors. It’s like a fortress safeguarding your treasures in the land of sun and dreams. But don’t celebrate just yet; other states, like Florida, allow creditors to access your safe deposit box and seize assets to satisfy a debt. It’s like a shark lurking in the tropical waters of debt collection.

The Devil in the Details

Now, let’s zoom in on the specifics. If you’re wondering what kind of debts could lead to a potential garnishment of your safe deposit box, think along the lines of unpaid taxes, child support, or outstanding loans. These are the monsters hiding under the bed that debt collectors thrive on.

Not So Fast, Debt Collector!

But fear not, you valiant protector of your prized possessions! While some states may allow creditors to swoop in and snatch your belongings, they must first obtain a court order or judgment. This means they can’t simply waltz into the bank like a bull in a china shop. There are protocols to follow and legal hoops to jump through, giving you a fighting chance to defend your hoard.

A Weighty Decision

Ultimately, the decision lies in the hands of the judge. They will consider the circumstances, the nature of the debt, and the potential consequences before granting access to your safe deposit box. So, keep it locked up tight and hope that the scales of justice tip in your favor.

A Game of Hide and Seek

If you’re worried about debt collectors sniffing around your safe deposit box, you may be tempted to play a little game of hide and seek. However, in the eyes of the law, intentionally hiding assets from creditors is a big no-no. It’s like trying to camouflage yourself in a neon tutu at a black-tie event. So, resist the urge to pull a magician’s disappearing act and face your debts head-on.

The Final Verdict

In this intricate dance between safe deposit boxes and garnishment, there are no guarantees. The laws can be complex and confusing, but knowledge is power. Understand the laws in your state, consult with legal professionals, and take proactive steps to secure your financial future. And remember, the best defense is a good offense when it comes to protecting your treasure trove.

Now that we’ve journeyed through the depths of the legal world, it’s time to rest easy knowing that your safe deposit box may have a stronger shield than you thought. But stay vigilant, for the forces of debt collection can be relentless. Keep your valuables secure, your debts in check, and may the gavel of justice always swing in your favor.

FAQ: Can a Safe Deposit Box be Garnished?

Can a Creditor Seize a Joint Bank Account

If you’re worried about creditors getting their grubby hands on your joint bank account, here’s the scoop. Unfortunately, they can! A creditor has the power to seize funds from a joint bank account to recover their outstanding debts. So, if your joint account partner owes money, your hard-earned cash could be on the line.

How Many Notices Does the IRS Send Before Levy

Ah, the IRS, those masters of bureaucracy. Before they swoop down like hawks ready to nab your nest egg, they’ll typically shower you with not one, not two, but three notices. Yes, you read that correctly. Three! The IRS wants to make sure you’re well-aware of their intentions before they start levying your assets. So, if you’re counting, that’s three notices and a whole lot of heartache.

Can a Safe Deposit Box be Garnished

Picture this: Secret documents, hidden treasures, and a safe deposit box locked away from prying eyes. You might think your precious stash is safe from the clutches of garnishment, right? Well, think again! Sadly, a safe deposit box can be garnished. If the court issues a judgment against you, those shiny valuables tucked away in your box could become fair game. So, be cautious with what you choose to squirrel away.

Is Levy Paid Monthly

Ah, the good ol’ levy. Just when you thought it wouldn’t get any worse, you wonder if you’ll ever catch a break. But fear not, my friend, the levy is not a monthly subscription service. Once the IRS imposes a levy, it will continue until they’ve collected the full amount owed or you take necessary steps to resolve the issue. So, hold onto your wallet, because that levy might be sticking around longer than you’d like.

Remember, when it comes to garnishments, levies, and joint accounts, it’s essential to stay informed and tread carefully. Knowledge is power, and now that you’re armed with these frequently asked questions, you’ll be better prepared to protect your hard-earned assets from those seeking a piece of the pie. Stay vigilant, stay wise, and keep those garnishing goblins at bay!

Note: This article is for informational purposes only and should not be considered legal advice. If you’re facing garnishment or have concerns about your financial situation, consult a qualified professional for guidance tailored to your specific circumstances.

[SEO]: Search Engine Optimization[IRS]: Internal Revenue Service